Investor appetite for alternative proteins continues to grow amid a period marked by health and environmental crises, signaling sustained interest in planet-friendly alternatives

As the world continues to grapple with health and environmental crises, the growing interest in alternative proteins is a clear indication of a sustained desire for planet-friendly investments that go beyond the bottom line.

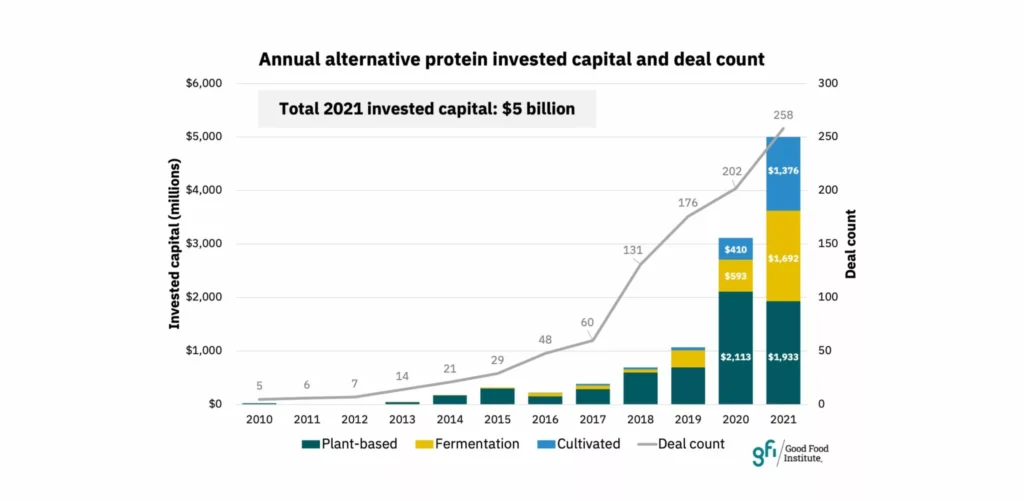

New data from The Good Food Institute (GFI) shows that global alternative protein companies raised a record $5 billion in disclosed investments in 2021, a 60% increase from the $3.1 billion raised in 2020 and five times the amount raised in 2019.

The GFI analysis, which was conducted using the PitchBook Data platform, indicates that the alternative protein industry is experiencing a period of rapid growth.

- Cultivated meat and seafood companies raised $1.4 billion in investments in 2021, the most capital ever raised in a single year for the industry and more than three times the amount raised in 2020.

- Fermentation companies devoted to alternative proteins secured $1.7 billion in investments in 2021, nearly three times the $600 million raised in 2020.

- Plant-based meat, seafood, egg, and dairy companies raised $1.9 billion in investments in 2021, on par with the $2.1 billion raised in 2020 and almost three times the $693 million raised in 2019.

The data also shows that the investor base for alternative protein companies is expanding, with the industry’s investor base growing by 62%, 43%, and 40% in cultivated meat and seafood, fermentation, and plant-based meat, seafood, egg, and dairy companies, respectively.

The public health and environmental crises of 2020 and 2021 have highlighted the risks associated with traditional business practices and portfolios, making the prospect of meat produced with zero risk of zoonotic disease transmission and significantly lower emissions than conventional meat even more appealing to investors.